Retirement planning is something that you need to face at one time or the other. Most young blood starting with their careers tend to procrastinate the subject to be tackled once they are in their mid-thirties or older. However, given the ever-changing economic situation, the uncertain future of Social Security and pension funds, you cannot afford to delay the matter. The adage, ‘the early bird catches the worm’ hits the bull’s eye with retirement planning.

The planning is no longer tough as well as it was just a couple of decades ago. Not only do you have several credible financial advisors and firms assisting you in meeting your goals, but you also have several online retirement planning software available, both free and paid to make your job much easier. Let’s check out a few leading advantages of planning your retirement early.

Peace of mind

This is the deal-breaker advantage of retirement planning. When you get into it early, you do not feel the heat and the burden of saving and can comfortably reach your retirement goals. Moreover, an amazing peace of mind prevails that your retirement years are well-taken care of and you can enjoy your life even after retirement.

Also Read, TIPS TO HELP YOU PREPARE FOR ENTRY-LEVEL IT CAREER

Reap the benefit of compounding interest

The earlier you start planning your retirement; the more time you give to your money to compound. Compound interest means you’re getting interest based on your initial principal amount as well as the interest amount that you have accumulated till that time. This makes funds grow to a significant value, even with an insignificant principal amount. Thus, you can build a hefty retirement egg without putting the extra labor of earning more.

Contextualize pre-retirement decisions

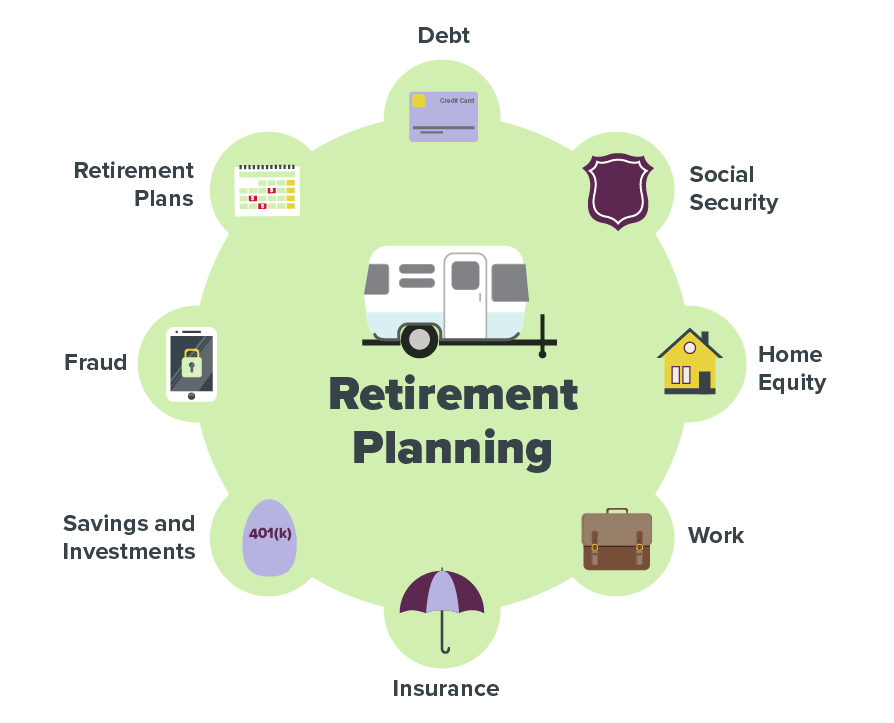

When you start planning your retirement, it becomes the focal point of financial planning. You start taking more efficient career and financial decisions that help you reach your goal easily. Thanks to the availability of various retirement planning software; you are guided on the right path. They analyze various data and let you know how much you need to save and how can you maximize that saving.

Most give you a visual representation that further etches in your mind. The chances of going wrong become negligible. You do not face the panic and crisis that most late retirement planners face.

Tax benefits

Early retirement planning brings you several tax benefits. Not only you pay less tax during your retirement years, but even your beneficiaries are required to pay the minimum possible taxes. While saving for taxes, many people overlook tax diversification. This means spreading your money in various accounts that are tax-free, taxable, and tax-deferred.

With the help of expert financial advisors and retirement planning software, you get a chart and visual view that helps you in diversifying your portfolio to maximum benefit.

Cost-saving and bigger savings

The younger you start to save; the more cost-effective your payment debts are. For instance, term whole universal life insurance requires a lower premium from a young person. Thus, you pay less. The risk-taking ability of a young person is much higher than a middle-aged person or a person approaching retirement. Thus, chances of him making a cool profit from his investments are much higher than that of a middle-aged person.

The personal financial responsibility for a young guy is much less than that of a married man or one with children. Thus, he can take a larger portion out of his earnings and put them in his retirement fund for larger growth. This privilege is absent when you start late with your retirement planning goals.

Early retirement option

When you start planning early and take judicious risks, you can meet all your retirement goals much faster. Thus, not only you get stress-free with your goals, but you can also plan an early retirement for yourself and enjoy the golden era of retired life. You can shift your focus from planning your finances and look into other important matters of your life. The financial freedom that you achieve goes a long way in creating a contented and happy life for you.

Read, WHICH TOOLS ARE USED TO RECOVER A STUCK PIPE?

Wrapping up

The biggest advantage of retirement planning is the freedom and dignity that it provides you to live your retirement years on your own terms. You do not turn a liability on your family but an asset to them. No reason can be more compelling than this to start planning early.

Leave a Reply